In today’s digital age, shopping online has become second nature to most of us. With the convenience of shopping from the comfort of home, who doesn’t love scoring great deals with a few clicks? If you frequently shop on Amazon, you might already be familiar with the ICICI Amazon Credit Card, a co-branded card designed to offer maximum benefits for online shoppers. But what makes this card stand out from the rest, and why is it a must-have for Amazon enthusiasts? Let’s dive in.

What is the ICICI Amazon Credit Card?

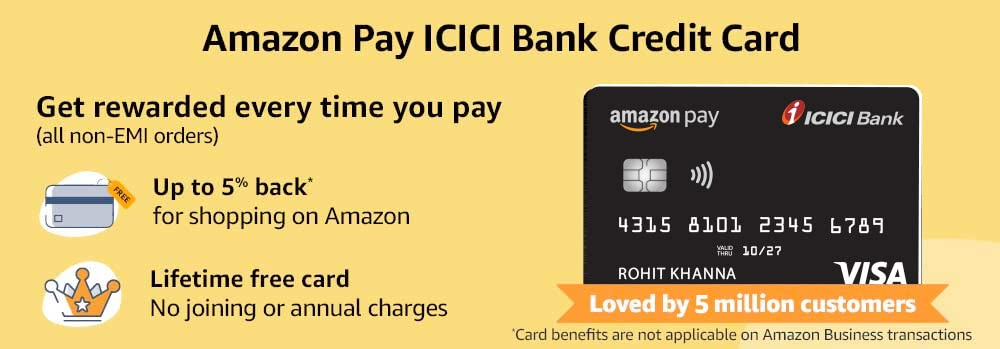

The ICICI Amazon Credit Card is a collaborative effort between ICICI Bank, one of India’s leading financial institutions, and Amazon, the world’s largest online retailer. This card is tailored specifically for Amazon shoppers, offering a range of rewards and benefits that can help you save more on every purchase you make.

Whether you’re a Prime member or a regular shopper, this credit card provides value in terms of cashback, discounts, and other perks, making your online shopping experience more rewarding.

Key Features of the ICICI Amazon Credit Card

- No Annual Fee: One of the most appealing features of the ICICI Amazon Credit Card is its zero annual fee. That’s right! You don’t need to worry about a yearly charge eating into your savings. This makes it an ideal card even for those who may not shop very frequently.

- Exciting Cashback Offers:

- 5% Cashback for Prime Members: If you’re an Amazon Prime member, you’ll enjoy a generous 5% cashback on all your Amazon India purchases. Whether you’re buying electronics, clothing, groceries, or even books, you’ll receive this cashback instantly on every transaction.

- 3% Cashback for Non-Prime Members: Even if you aren’t a Prime member, the card still offers an impressive 3% cashback on Amazon purchases.

- 2% Cashback on Partner Merchants: ICICI has partnered with over 100 merchants where you can avail of 2% cashback, including Swiggy, BookMyShow, and more.

- 1% Cashback on All Other Purchases: For every other transaction, whether you’re filling up fuel, dining out, or making utility bill payments, you get 1% cashback, making the ICICI Amazon Credit Card a versatile option for everyday use.

- No Minimum Spend Limit for Cashback: Many credit cards require you to reach a certain spending threshold before you can benefit from cashback offers. With the ICICI Amazon Credit Card, there’s no such restriction. You earn cashback from your very first rupee spent, making it hassle-free and easy to use.

- Fuel Surcharge Waiver: For those who drive, this card offers a 1% fuel surcharge waiver at all petrol pumps across India, adding to your savings.

- Contactless Payments: The card also supports contactless payments, allowing you to make fast, secure payments by simply tapping your card on a POS machine, without the need for a PIN for purchases up to ₹5,000.

Benefits for Amazon Shoppers

For regular Amazon customers, the ICICI Amazon Credit Card is a game-changer. Prime members, especially, can maximize their savings through the 5% cashback offer, which is one of the highest in the market for any co-branded card.

The card is seamlessly integrated with your Amazon account. This means that every time you shop, your cashback is automatically credited to your account as Amazon Pay balance. This balance can then be used for future purchases on Amazon or for various services like mobile recharges, bill payments, or booking movie tickets. This feature eliminates the waiting period or cumbersome redemption processes associated with traditional cashback cards.

How to Apply for the ICICI Amazon Credit Card

The process of applying for the ICICI Amazon Credit Card is straightforward:

- Eligibility: To apply, you need to be at least 18 years old with a stable source of income. You do not need to have an existing ICICI Bank account.

- Application Process: You can apply directly through the Amazon website or the ICICI Bank portal. You will need to provide basic details such as your PAN, Aadhaar, and proof of income.

- Approval Time: Once you apply, you can expect swift approval, and your credit card will be dispatched within a few working days.

Once approved, you can immediately begin using the card for Amazon purchases, even before the physical card reaches you, thanks to a virtual card that gets activated instantly.

Why Choose the ICICI Amazon Credit Card?

image credit: CardExpert

In an ever-growing world of online shopping, finding a credit card that truly enhances your shopping experience is a challenge. The ICICI Amazon Credit Card stands out not only because of its no annual fee structure but also due to its high cashback rates, especially for Prime members.

This card is perfect for:

- Frequent Amazon Shoppers: If you regularly purchase from Amazon, this card will help you maximize savings with its high cashback rates.

- Prime Members: The 5% cashback is unbeatable, and for someone who makes the most of Amazon Prime’s benefits, this card is an ideal match.

- Everyday Spend: Even beyond Amazon, the ICICI Amazon Credit Card is a good choice for daily transactions with its 1% cashback on all other purchases.

Conclusion

If you’re someone who enjoys shopping on Amazon or simply wants a credit card that offers great rewards across various categories, the ICICI Amazon Credit Card should be at the top of your list. Its combination of no annual fees, high cashback rates, and ease of use makes it one of the most value-packed credit cards in India.

So, whether you’re buying essentials, splurging on tech gadgets, or just doing your routine grocery shopping, the ICICI Amazon Credit Card can help you save more and make your shopping experiences even more enjoyable.

Make every purchase count and turn your love for shopping into tangible rewards!