Managing your finances can be challenging, especially when it involves credit lines like Flipkart Pay Later EMI. This service allows you to shop now and pay later, with the option to convert payments into monthly installments. However, there might come a time when you want to close your Flipkart Pay Later EMI account, whether because you’ve cleared your dues or simply want to discontinue the service. This guide will walk you through the process of how to close Flipkart Pay Later EMI effectively, ensuring a smooth and hassle-free experience.

What is Flipkart Pay Later EMI?

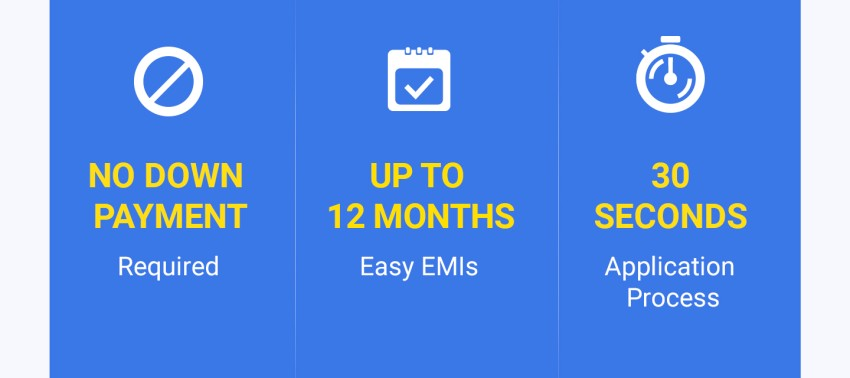

Flipkart Pay Later EMI is a payment option provided to eligible customers, allowing them to purchase items immediately and pay for them in installments. It’s particularly useful for larger purchases as it spreads the cost over a few months. Flipkart collaborates with financial partners to offer this service, and users can repay in convenient EMIs.

While this feature is beneficial, it’s essential to know how to manage and close the account when you no longer need it.

Why You Might Want to Close Flipkart Pay Later EMI

There are several reasons why you might choose to close your Flipkart Pay Later EMI account:

- Debt Control: You might want to reduce or eliminate credit lines to better control your financial commitments.

- Avoid Interest or Late Fees: To avoid accruing additional charges from delayed payments.

- Completed Payments: Once you’ve paid off all your EMIs, you may not want to keep the account open.

- Financial Simplification: If you’re aiming to streamline your finances, closing unused credit accounts is a smart move.

- Service Dissatisfaction: If you’re unhappy with the service or find a better option, closing the account might be the next step.

How to Close Flipkart Pay Later EMI in 5 Simple Steps

1. Clear Your Outstanding Balance

Before initiating the closure process, make sure you have no outstanding dues. You can check your current EMI status by following these steps:

- Log in to your Flipkart account via the app or website.

- Navigate to the “Flipkart Pay Later” section under the “My Accounts” or “Payment” tab.

- Check your remaining balance and transaction history.

Pay off any outstanding amounts to avoid penalties or complications. Once your account shows a zero balance, you can proceed with the next steps.

2. Settle All Payments

If you find any pending amounts, it’s crucial to clear them immediately:

- Go to the “Flipkart Pay Later” section in your account.

- Choose the option to “Pay Now” or “Make Payment.”

- Use any payment method like UPI, credit card, or debit card to complete the payment.

Ensure that your payment is reflected in your account, showing no balance due.

3. Contact Flipkart Customer Support

To officially close your Flipkart Pay Later EMI account, you’ll need to contact customer support, as there’s no automatic option available in the app or website. Here’s how to go about it:

- Go to Flipkart’s “Help Center” from the app or website.

- You can choose to chat with a representative, make a phone call, or raise a support ticket.

- Inform the support team that you wish to close your “Flipkart Pay Later EMI” account and confirm that all dues have been cleared.

Make sure to provide all relevant account details to expedite the closure process.

4. Confirm Account Closure

Once your request is processed, you will receive a confirmation from Flipkart. This may take a few days depending on their workload, but it’s important to follow up:

- Check your registered email for any official closure confirmation.

- Keep an eye on the Flipkart Pay Later section in your account to ensure the service is deactivated.

- Monitor your credit report to ensure that the account closure is reflected accurately, as it may take a few weeks to update.

5. Monitor Your Credit Report

Since Flipkart Pay Later EMI services are tied to financial institutions, the closure may impact your credit score. It’s crucial to monitor your credit report after the account has been closed. You can check your credit report through agencies like CIBIL, Experian, or Equifax. If any discrepancies appear, contact both Flipkart and the credit reporting agency to rectify the issue.

Best Practices for Managing Your Flipkart Pay Later EMI

Whether you’re closing your account or continuing to use it, managing Flipkart Pay Later EMI responsibly is key to maintaining a healthy financial profile. Here are some tips:

1. Set Up Payment Reminders

To avoid late fees or penalties, always set up payment reminders for your EMI dues. You can use apps or calendar notifications to ensure you never miss a due date.

2. Avoid Unnecessary Purchases

Even though Pay Later options offer flexibility, they can also encourage overspending. Always stick to your budget and avoid unnecessary purchases just because you can defer payment.

3. Understand EMI Terms

Whenever you opt for an EMI, review the interest rates, tenure, and any hidden charges. Some plans may offer no-cost EMI, but it’s always wise to understand the full terms before agreeing to them.

4. Track Multiple Credit Lines

If you’re using several credit options, such as Pay Later services, credit cards, or loans, it’s important to track each account. Keeping an eye on your financial obligations helps prevent missed payments and allows you to manage your credit score effectively.

External Resources for Financial Health

For additional guidance on managing credit and financial health, you can visit resources such as:

- RBI’s Consumer Education for information on personal finance and credit management.

- CIBIL Score Guide to understand how to monitor and improve your credit score.

Conclusion

Closing your Flipkart Pay Later EMI account is a straightforward process, but it requires that you follow the right steps to avoid any issues. Ensure that all your outstanding payments are cleared, contact customer support to officially close the account, and monitor your credit report to confirm that everything has been processed correctly.

By responsibly managing services like Flipkart Pay Later EMI, you can maintain a strong financial profile and avoid unnecessary debt. Whether you choose to close your account or keep using it, understanding the implications on your credit score and financial management is crucial.

Remember, staying on top of your payments and consolidating debt when necessary can go a long way in improving your financial well-being. Happy shopping – responsibly, of course!

Internal Link Suggestions:

External DoFollow Links: